Techarc’s India Connected Consumer 2025 report: 2025 to mark beginning of ‘smartphone era’ of cars in India

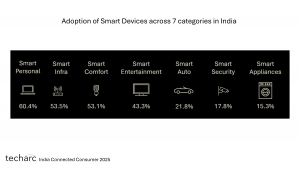

The ownership of smart devices continues to grow in India. However, the actual usage of some categories is on the decline, reveals ‘Techarc’s India Connected Consumer 2025’, the 5th edition of the report published by Techarc annually.

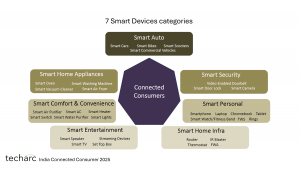

The report which presents insights about 7 categories of smart devices covering 33 products is based on consumer survey with a sample size of 4,500 respondents from metro and non-metro cities of India. This year’s deep dive segment covers connected cars, for which interactions with subject experts representing the auto tech enablers were also done.

For the first time the report includes ‘Smart Auto’ as the 7th category completing the smart devices spectrum available to connected consumers in India.

Sharing the key insights of the report, Faisal Kawoosa, Chief Analyst and Founder, Techarc said, “While it is heartening to see that smart devices continue to become integral in shaping our technology led lifestyle, there is a diminishing interest in some of the products felt by the consumers which is affecting the growth prospects of these products and categories in India.”

“The connected customers don’t mind paying more if they get the quality and real unique value through these smart devices. This signifies a big shift in the buying behaviour of connected consumers who are giving up ‘crap-tech’ and appreciating ‘qual-tech’ coming from the ecosystem,” added Faisal.

Smart Devices key insights

- Smartphone continues to remain central to the Connected Consumer ecosystem. No other smart device gets the same importance as a smartphone.

- Many consumers own several smart devices but are not actively using them. They are finding the relevance of such devices going down with the passage of time. On average 27% of the respondents have stopped or reduced using at least one of the smart devices they own.

- Consumers are interested in spending on improving the value proposition in terms of features, quality and experience rather than exploring too many smart devices. 22% of the respondents shared about considering optimising their smart devices portfolio.

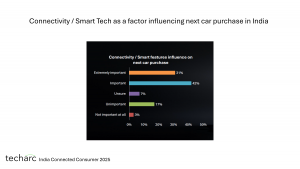

- Among the new set of categories, Smart / Connected Cars is generating high interest among consumers. 55% of the respondents said that they have come across news or information about smart / connected cars in recent times.

- Consumers are keen to understand and see how AI can help improve the relevance of smart devices across the spectrum. 42% of the respondents feel AI features might change their opinion about the utility of several smart devices.

- The awareness about the presence of chipset being a critical component defining and powering the capabilities of smart devices is increasing. This year 73% of the respondents were aware of the role a chipset plays in smart devices.

- Among the pureplay chipset makers, MediaTek led the smart devices by powering 38% of the devices being used by the connected consumers followed by Qualcomm at 24%. Intel stood third with 7% of the devices being powered by them. There were also several respondents (18%) who were unaware of the chipset powering their smart devices.

Sharing about the findings of the deep dive section of this report about connected cars, Sadat Ahanger, Analyst AutoTech sector at Techarc said, “With connectivity and the technologies it brings to the cars, the future of automobile sector will be fundamentally determined by the auto-technologies that will influence the overall experience, performance, comfort, safety and entertainment available to the drivers as well as the passengers. So far, such features were seen as luxury or high-end experiences. But starting 2025, many of these will become mainstream for cars in India.”

Connected Cars key insights

- 2025 onwards, passenger cars launched in India will se 5G M2M connectivity, on device GenAI, cloud connectivity and multiple displays across price segments. However, most of the cars to be launched in the price range of ₹20 Lakh and above will have 5G M2M connectivity and on-device GenAI as default technologies.

- Globally, technology providers like chipset industry foresees automotive connectivity having opportunity of equal to mobile business. The cumulative revenues of chipset companies like Qualcomm and MediaTek have already crossed US$.15 billion from the automotive sector and is registering a healthy double-digit growth in revenues year on year.

- Despite auto sector in India witnessing inventory build-up especially in the mid segments, the journey to innovation and introduction of technology features is on with complete zeal. All the car OEMs have connected cars as a core strategy area being pursued irrespective of the segments they focus on.

- In-car computing & intelligence (GenAI) and cloud applications will become integral to cars helping real-time processing of data to assist drivers.

- OEMs and technology providers are very closely collaborating to explore how best the available technology blocks be used and localised in the Indian context. The entire ecosystem agrees that mere ‘importing’ of technology will not yield results as consumers will prioritise technology and connected features through their own relevancy benchmarking that is defined by very localised and personalised used cases.

- Telematics and infotainment are the two areas which technology providers see as early use cases for passenger vehicles. The consumers will also be able to enjoy enriched comfort while in the vehicle as drivers or passengers.

- Cars will increasingly have multiple displays for the cockpit as well as the cabin serving different needs of driver and passengers.

- Automotive sector will skip the 4G connectivity and straight away enable connectivity using the latest 5G cellular technology. This has the potential of India becoming the largest 5G M2M market in the world in next 2-3 years.

- There are already 22 automobile OEMs that are manufacturing their cars in India across different segments. Cumulatively they produce close to 5 million passenger vehicles annually.

- From domestic ecosystem, Reliance, through Jio Platforms is holistically focusing on this evolving opportunity and has already developed several blocks of the tech stack that will substantially make India ready use indigenously developed ready to deploy technology for OEMs.

- While aligning with the global trends where telematics and infotainment are two early application areas of connected cars, in Indian context other areas such as safety and security are also going to be very relevant. As per the ‘Road accidents in India 2022’ report of Ministry of Road Transport and Highways, there were 461,312 road accidents reported by different state and UT Police departments. These accidents resulted in 168,491 deaths and 443,366 injuries. With V2X capabilities connected cars can significantly help in avoiding road collisions.

- Auto tech enablers have created holistic solutions addressing concerns including balancing the driver-vehicle decision making, cyber security challenges and data encryption & privacy for responsible use of connected cars.

- Some of the familiar applications that consumers will be able to use while driving include communication apps for audio/video conferencing, OTT entertainment apps, music streaming, podcasts, online shopping, vehicle maintenance and servicing, etc.

- Car OEMs having forayed early in the connected / smart cars space and positioned it strongly among consumers are seen as the leading brands driving this trend by consumers. 21% of the respondents felt that MG Motors leads in offering connected cars in India, followed by Kia Motors and Tata Motors respectively with 18% and 15% of respondents opining in their favour. The other two brands that featured in top 5 included Hyundai and Maruti Suzuki.