HFCL Delivers improved Q1 FY26 Performance with Robust Order Book, Global Demand Revival, and Strategic Wins in Defence and Telecom

HFCL Limited (HFCL), a leading technology enterprise in telecom and defence, reported a solid start to FY26 with strong operational momentum, landmark orders, and strategic capacity expansions across key business segments.

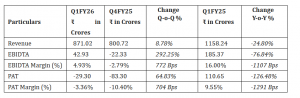

Despite macroeconomic headwinds, the Company recorded revenue of ₹871 Crores in Q1 FY26, up from ₹801 crore in Q4 FY25, and reported a sharp recovery in EBITDA at ₹42.93 Crores compared to a loss in the previous quarter. While PAT stood at ₹(29.30) Crores, the performance marked significant operational improvement, and laid the foundation for a strong FY26. HFCL’s order book surged to ₹10,480 Crores, reflecting growing customer confidence and demand visibility.

Consolidated Financial Highlights – Q1FY26

Ona standalonebasis,theCompanyreportedquarterlyrevenueof ₹789.28 Crores, EBIDTAof₹12.99 Crores,PBT of ₹-62.89 Crores andPATof₹-42.34 Crores.

Key Business Highlights:

Strong Comeback in Optical Fiber Cable (OFC) Business

After several muted quarters, HFCL’s OFC business witnessed a strong rebound in Q1 FY26, driven by ₹300 Crores worth of new export orders and ₹210 Crores in export revenues. The Company gained product approvals from several new international clients and also received repeat orders from leading global customers, particularly across Europe and Asia.

To cater to rising demand from hyperscale data centres and digital infrastructure globally, HFCL’s Board approved the expansion of IBR cable capacity from 1.73 million to 19.01 million fibre kilometres per annum, increasing total OFC capacity to 42.36 million fkm per annum, positioning the Company as one of the leading global supplier.

Make-in-India Push in Telecom Equipment

HFCL achieved a major milestone by developing and commercially deploying indigenous MPLS routers, securing ₹650 Crores in orders under BharatNet Phase III, and also bagged a repeat order worth ₹175 Crores for its 5G networking gear from a domestic telecom operator. With expanding product lines across 5G, enterprise, and data centres, HFCL continues to climb the value chain with next-gen telecom solutions.

Defence Business Gaining Global Traction

HFCL’s defence business made remarkable progress, securing a breakthrough order for thermal weapon sights for AK-203 rifles and emerging as the L1 bidder for a ₹90 Crores tactical cable order. The Company also signed two technology licensing agreements with DRDO for advanced battlefield solutions. Final testing of our electronic fuzes for artillery guns by DRDO is scheduled for August 2025.

The Company showcased its cutting-edge defence portfolio at the 55th Paris Air Show, attracting strong interest from global OEMs and partners. HFCL is now advancing indigenous solutions such as coastal and drone detection radars and unmanned aerial platforms, with several technologies already in the testing or pre-production phase.

Strategic Expansion in Passive Connectivity and Reinforcement Solutions

HFCL secured multiple orders for Passive Connectivity Solutions (PCS) and export orders for UV and thermal FRP rods, expanding its global footprint. PCS is expected to see significant revenue growth, driven by increasing demand from telcos and data centres.

Outlook

Commenting on the performance, Mr. Mahendra Nahata, Managing Director, HFCL said: “Q1 FY26 has set a strong foundation for what we believe will be a breakout year for HFCL, with 66% of our revenue coming from the product segment and exports contributing 24% to the total revenue. We expect this positive momentum to continue and strengthen in the upcoming quarters. Our strategic shift towards high-tech, value-added products in telecom and defence is already yielding encouraging results. With growing global demand, the Government’s push for Atmanirbhar Bharat, and our expanding manufacturing capabilities, HFCL is well-poised to lead in next-generation connectivity and secure communication technologies. We remain confident in our ability to deliver sustained value to all stakeholders in FY26 and beyond.”