Industry Experts on GST 2.0 reforms

Snehdeep Aggarwal, Founder & Chairman, Bhartiya Group (a global corporation with interests in real estate and fashion across India, Italy and China)

“The reduction of GST on cement, steel and related construction materials is a timely and much-needed boost for the real estate sector. Lower input costs will allow developers to invest more in superior design, modern amenities, and sustainable practices, while ensuring greater affordability for homebuyers. Corporate real estate too will benefit from improved cost efficiencies, making office and commercial projects more attractive for businesses and investors. With more disposable income in the hands of customers, this reform is set to accelerate demand and strengthen transparency across the industry.”

Sriram Kannan, Founder & CEO, Routematic (leading corporate transport solutions provider)

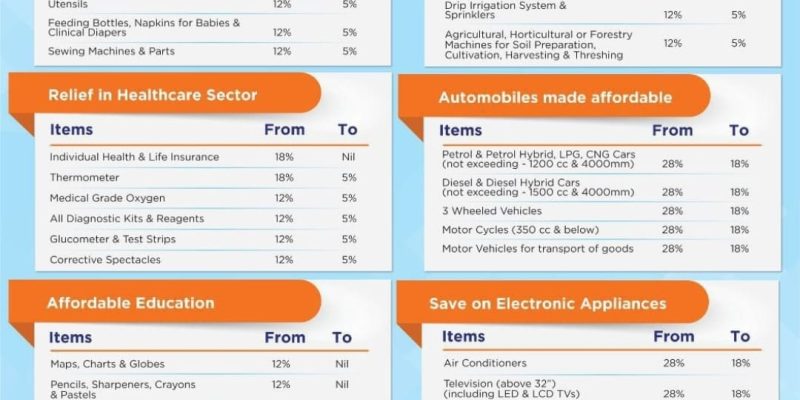

“The GST 2.0 reforms will significantly transform the corporate commute ecosystem in which Routematic operates. By reducing GST on commercial vehicles from 28% to 18%, more driver-partners will find it viable to purchase ICE vehicles at lower EMIs boosting their earnings and livelihood security. For Routematic, this directly translates into a larger and more reliable supply pool of vehicles, enabling us to offer corporates more affordable and scalable commute programs. At the same time, retaining the 5% GST rate on electric vehicles ensures that EV leasing remains attractive for India’s sustainability goals. However, for EV adoption to truly accelerate, these tax incentives must be complemented by rapid expansion of charging infrastructure.”

Vasudha Madhavan, Founder and CEO, Ostara Advisors (India’s first climate tech investment banking firm)

“The government’s decision to keep all EVs—whether mass market or luxury SUVs—under the 5% GST slab without any additional cess is a progressive step that will have a significant impact on adoption. By removing the tax disparity between smaller EVs and larger SUV models, the policy creates a level playing field, improves affordability, and encourages greater consumer choice. On the other hand, the move is expected to keep upfront costs low for customers while accelerating market growth. This will not only boost sales across segments but also reinforce confidence among manufacturers and investors in India’s long-term commitment to sustainable mobility. Importantly, it will also encourage our automotive component manufacturers to build a full-fledged EV component ecosystem in India. Ultimately, it signals India’s intent to make EVs mainstream rather than niche.”

Subroto Bose, Partner, ASA & Associates

“The recommendations on tax rate changes by the GST Council will have a huge positive impact on consumption and boost production. The 3-rate slab structure brings much needed clarity especially to foreign investors interested in the India growth story. Simplified GST registrations for small and low risk businesses and sanction of risk-based provisional refunds will reduce administrative bottlenecks and facilitate trade.”

Mr. Rana Dutta, Senior Vice President CNG Marketing & Business Development, THINK Gas

“By bringing down the GST rate on commercial vehicles where CNG contributes significant volume from 28% to 18% and CNG cars under 1200 cc from 29% (inclusive of cess) to 18%, the GST Council has created a strong incentive for customers to choose environment-friendly alternative. This reform is expected to significantly boost demand in the automobile sector while accelerating the adoption of natural gas as a preferred fuel, given its affordability and efficiency. This aligns well with India’s ambition to increase the share of natural gas in the energy mix from the current 6% to 15% by 2030, thereby reducing carbon emissions and improving air quality. The natural gas sector is poised to support customers who will be taking the decision to adopt CNG fuelled cars, SCVs, LCVs and Buses with strong and expanding infrastructure across India. This move will also encourage investments and support India’s energy transition goals. We see this as a measure that will promote sustainable mobility and ensure economic growth through higher CNG powered vehicle penetration.”